Nonprofit organizations take a unique approach to their accounting systems. This is because they must segment their funds, allocate them appropriately and according to specific restrictions, and reinvest all profits back into the organization’s mission. This makes it imperative for them to find sustainable revenue streams to support the nonprofit and to maintain a sustainable system of recording their financial transactions.

The tool that nonprofits can use to segment their funds and make reporting on their financial practices is called the chart of accounts (COA). The nonprofit chart of accounts helps organizations effectively organize their revenue and expenses into specific categories, effectively segmenting money into the funds necessary to manage a system based on fund accounting.

In this guide, we’ll go over the nonprofit chart of accounts, how it organizes funds, and why it’s an important tool for nonprofit organizations. This resource can be the backbone of effective nonprofit accounting practices when used properly. Without further ado, let’s dive into the definition of a nonprofit chart of accounts.

The nonprofit chart of accounts is a systematic numbering system that categorizes your nonprofit’s transactions, breaking down your revenue and expenses into further categories necessary for fund accounting.

Essentially, your chart of accounts helps organize the key financial data your nonprofit has about your finances so it can be further used to compile other financial reports and statements that provide financial insight for your organization.

When you pull financial reports, the data will come from your chart of accounts. Some of these key reports will include your:

Your accounting team can also review your nonprofit chart of accounts when preparing your budget for the coming year. It provides a detailed view of your funds entering your system as well as your expenses, helping estimate a more accurate financial plan that will support your organization’s mission.

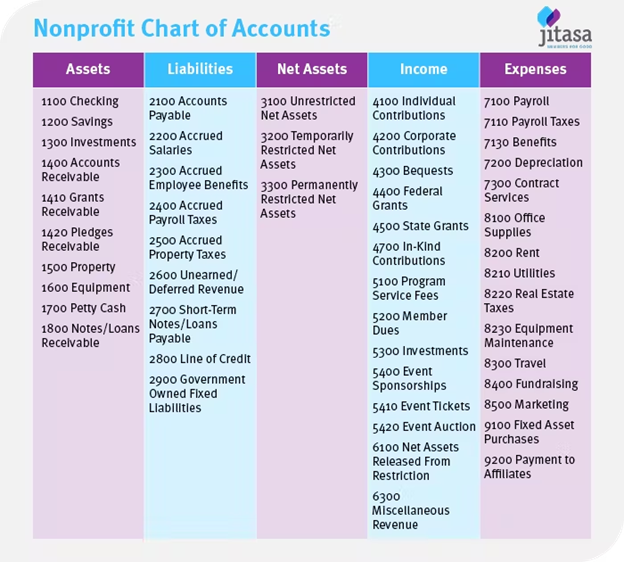

As we mentioned before, your nonprofit chart of accounts provides a numeral system for organizing your financial information. This financial information is broken down into five main categories — assets, liabilities, net assets, income, and expenses.

Most nonprofit organizations use the same numbering system to organize this information, providing a different thousands number for each main category:

Under each of these categories falls sub-categories that will more specifically outline your organization’s finances. Consider, for example, if you receive a major donation from a dedicated supporter and that gift is restricted to supporting your nonprofit’s scholarship program. This contribution will be added to your individual contribution subcategory under your income COA category. It will also result in the adjustment of your restricted net assets category.

As you establish your nonprofit chart of accounts, be sure to leave some space between your categories and subcategories. This allows future accounts to be made and placed where they’re most appropriate within the chart.

Generally, your nonprofit chart of accounts looks more or less like a list of numbers associated with different types of transactions and financial information. Jitasa’s chart of accounts guide provides the following example of what one might look like:

After you’ve established your chart of accounts, you’ll need to maintain it and ensure it doesn’t become disorganized or dirty. NPOInfo’s guide to data hygiene explains that data is key to many operations, but it “fails to hold any value if you’re unable to identify your data when you need it. Without taking the necessary steps to keep your data up-to-date, clean, clear, and concise, it is virtually useless.” Charityproud makes it easy for you to keep your data accurate and clean. Donations are organized by restrictions, campaigns, and funds to help clearly track your cash flow. Our robust reporting module is also a great tool for extracting and analyzing data from your system.

Therefore, to keep the data held in your nonprofit chart of accounts as clean and tidy as possible, your nonprofit should make sure to:

Upkeep is essential for proper data hygiene no matter what software or database you’re working in. When so many of your key financial reports are pulled from your nonprofit chart of accounts, you’ll want to make sure your data is as accurate and organized as possible. .

Many nonprofit organizations choose to use the unified nonprofit chart of accounts, a templated chart of accounts for nonprofit organizations. However, this COA had to cover all of the basis for all organizations, making it incredibly detailed and extensive. While this works well for larger organizations, smaller organizations may prefer toning down this document or establishing their own smaller chart.

As we’ve covered in this guide, your nonprofit chart of accounts is a key resource for nonprofits to use to organize their finances. It’s important to establish one that will work best for your organization and will allow your accounting team to keep track of key financial data.